Stashfin Credit Line and Instant Personal Loan App Online

Enjoy the power of instant money with Stashfin- One of India’s fastest, easiest, safest, and smartest Credit Line and Personal Loan App. Stashfin is powered by Akara Capital Advisors, an NBFC duly registered with Reserve Bank of India (RBI). With its quick and easy loan application process, Stashfin lets you enjoy instant personal loans up to ₹5,00,000 at low interest rates and flexible repayment plans that are best suited to your needs.

Best Instant Personal Loan App in India

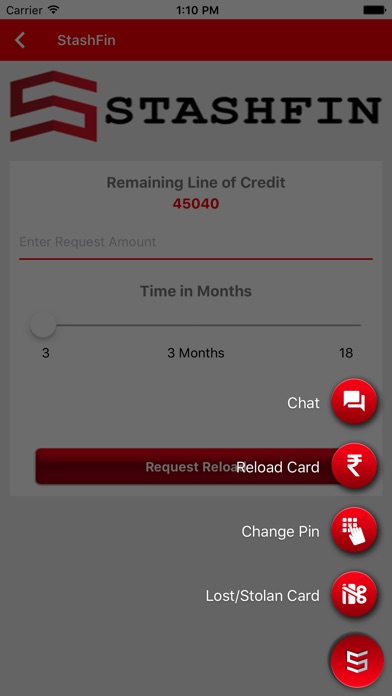

• Credit line ranging from ₹1,000 to ₹5,00,000 straight to your bank account. 24*7 access to cash

• Pay interest only on the funds you utilize

• Flexible payment terms. Repay your loan with convenient EMIs. Pick a tenure that works for you ranging from 3 months to 36 months

• Minimum documentation, instant approval, and quick loan disbursal.

• Transparent pricing. No hidden fees

• Completely secure process

• No joining fees

Instant Loan

We also provide small instant personal loan as low as ₹1,000 and up to ₹500,000 and we are operational in 30+ cities across India. In matters of funds, one size doesn’t fit all, and we offer you the choice of picking a credit line best suited to your needs and help you take control of your finances. We offer interest rates ranging from 11.99% - 59.99% APR (Annual Percentage Rate), the rates may vary on a case-to-case basis. All loans are paid through Equal Monthly Instalments (EMIs) via electronic payment. A low processing fee is charged in certain cases and there are no hidden costs.

Example-

Loan Amount: ₹10,000

Loan Tenure: 3 months

Rate of Interest: 11.99% p.a.

Processing Fee: ₹0

Total Interest: ₹167

Loan EMI: ₹3389

APR: 11.99%

Amount Disbursed: ₹10,000

Total Loan Repayment Amount: ₹10,167

*For selected customers with 0% interest for 30 days, there is a small transaction fee.

Sample Monthly EMI with Sample Principal and Interest

EMI Principal Interest

₹3389 ₹3305.74 ₹83.25

₹3389 ₹3333.26 ₹55.73

₹3389 ₹3361.01 ₹27.98

How does Stashfin Work?

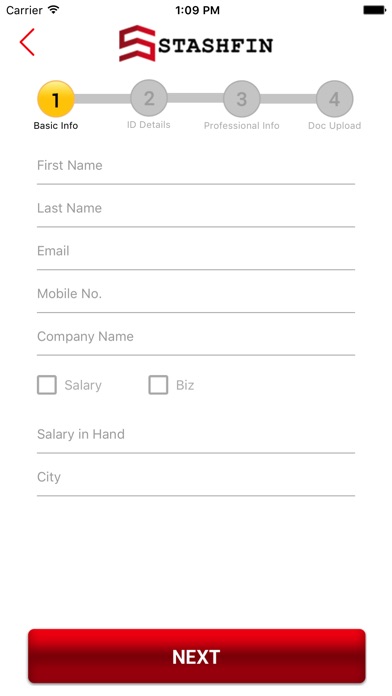

4 Easy steps to get instant cash loan and solve all your money problems

• Download the Stashfin App and register

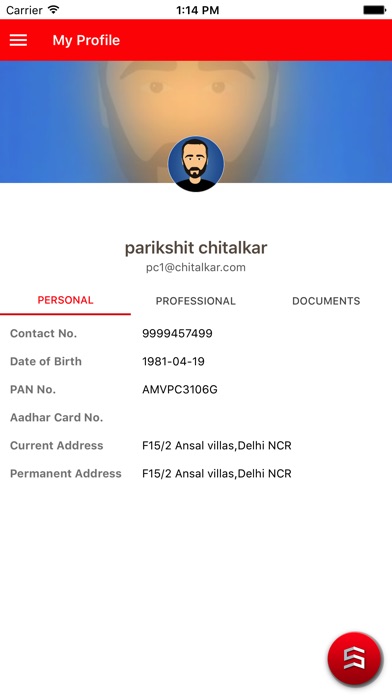

• Fill in your details and upload verification documents

• Once verified the final loan application status can be checked on the App You will also be notified of your approval status via SMS

• Once approved, E-sign the loan agreement and the approved amount will be disbursed to you within 5 minutes. An SMS notification will be sent to your registered number notifying the same

Eligibility Criteria to Apply for Instant Personal Loan-

• Indian Citizen

• Above the age of 18

• Must have a source of income (either salaried or self-employed)

Documents Required for Instant Personal Loan-

• Address Proof (any one of Aadhaar Card/Voter ID/Passport/Driving License)

• Identity Proof (PAN ID)

In some cases, you may be asked for the following documents

• Bank Statement

• ITR/ GST Paper

Stashfin is currently Operational in 30+ Cities-

Delhi NCR (Delhi, New Delhi, Noida, Greater Noida, Faridabad, Ghaziabad, Gurgaon), Mumbai, Thane, Pune, Hyderabad, Chennai, Bangalore, Indore, Chandigarh, Panchkula, Pithampur, Bhiwandi, Zirakpur, Kharar, Coimbatore, Kolkata, Allahabad, Udaipur, Jaipur, Lucknow, Prayagraj, Kanpur, Bhopal, Shimla, Haridwar, Ranchi, Ahmedabad, Mangalore and more.

Security & Protection of Privacy-

Data security and privacy is a top priority at Stashfin. Our backend APIs comply with mandated security standards and robust protocols which have been tested and certified.

Stashfin has partnered with reputed and well-regulated entities like SBM Bank, DMI Finance, Visu Leasing Finance, AU Small Finance Bank, Kisetsu Saison Finance, Chola Finance and Western Capital.

Stashfin Instant Personal Loan App requires the following permissions to function properly:

• Text messages

• One time access to Location, Camera & Media

• Limited Device Info.

For queries, please mail us at [email protected]